Renters Insurance in and around San Tan Valley

Welcome, home & apartment renters of San Tan Valley!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Think about all the stuff you own, from your furniture to bed to coffee maker to bedding. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Welcome, home & apartment renters of San Tan Valley!

Renters insurance can help protect your belongings

Open The Door To Renters Insurance With State Farm

Renting a home is the right choice for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance might cover damage to the structure of your rented home, but that doesn't cover the things you own. Renters insurance helps safeguard your personal possessions in case of the unexpected.

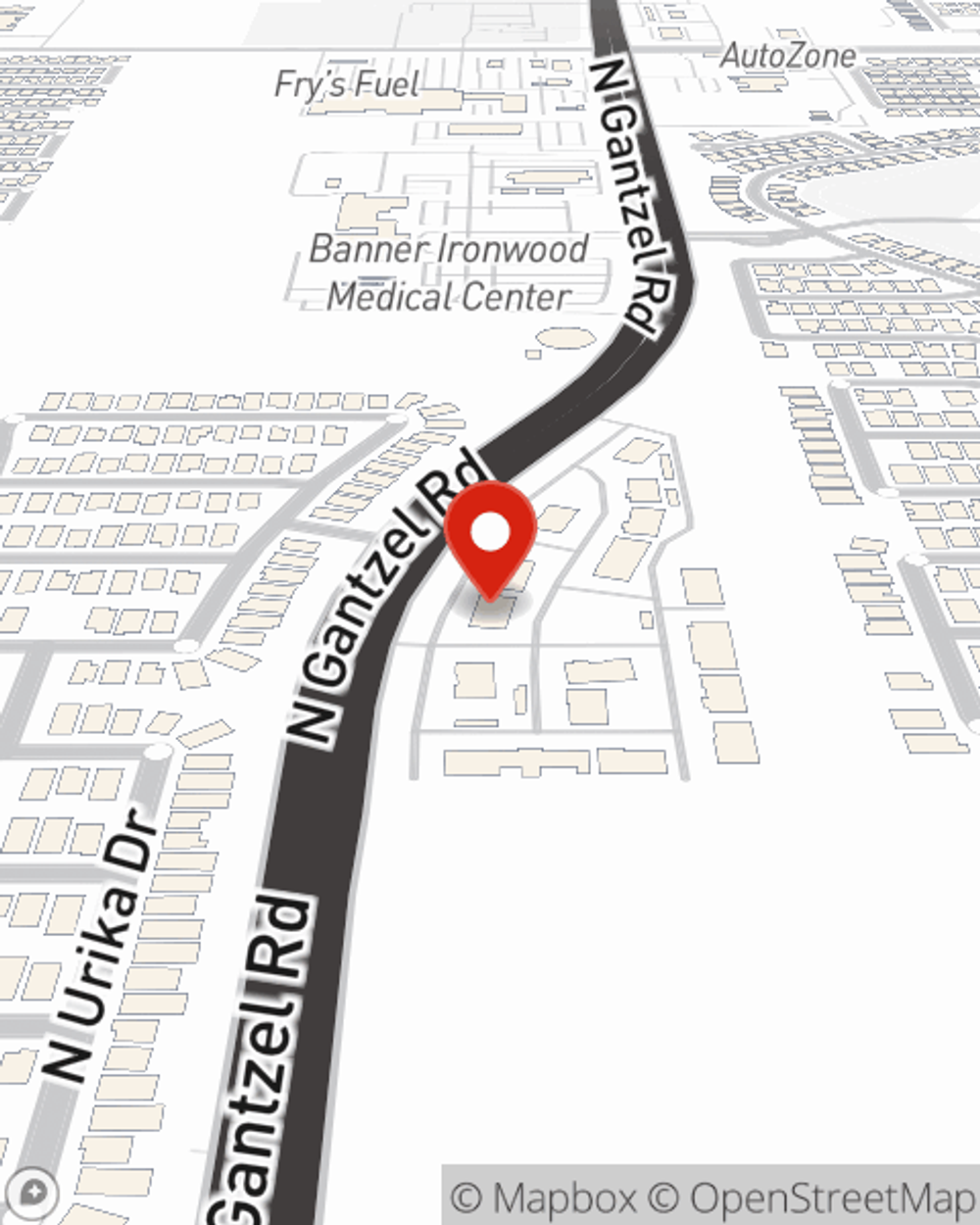

There's no better time than the present! Visit Sterling Campbell's office today to see how helpful renters insurance can be.

Have More Questions About Renters Insurance?

Call Sterling at (480) 307-9116 or visit our FAQ page.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.

Sterling Campbell

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Writing rental ads

Writing rental ads

Writing an effective rental ad will attract the most qualified and responsible tenants.